Find out how much you can really earn

With Bulldog Guide, you can see how much you'll actually earn, and you can do it through various forms of cooperation.

The Polish tax system is difficult to judge well, and everyone will probably agree on this point, regardless of economic views. Legislative chaos leads to the fact that it is not easy to even calculate one's own earnings.

With help comes Bulldog Guide, where you will find a practical and advanced calculator that allows you to calculate the actual amount of earnings regardless of the form of cooperation and additional factors.

Bulldog Guide

With Bulldog Guide, you can access valuable and mostly hard-to-find information about the realities of the Polish IT industry. Importantly, these are actual, hard data collected from the IT Community Report and job offers that appear on the website.

Of course, the salary calculator is just one component of Bulldog Guide – among other things, the ability to generate individual reports is also available, as we have written more extensively about here. It is enough to say that with a few clicks you can get a quick idea of the salary scale and get an idea of whether you are earning well in a given position or whether the rates offered by a potential employer compare competitively with the Polish IT industry.

Salary Calculator

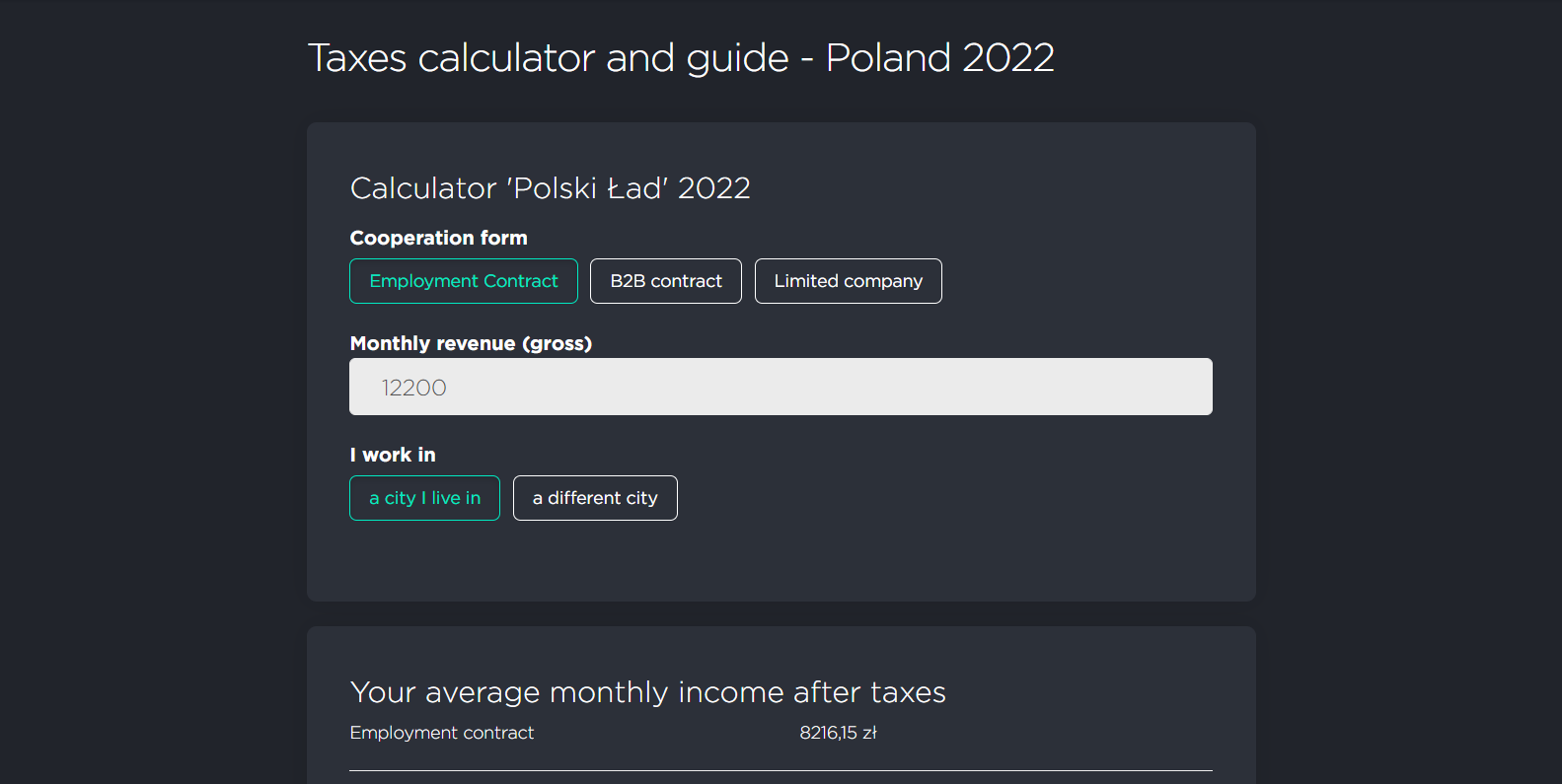

To use the salary calculator, simply create a Bulldog Guide account, then select "Tax calulator and guide" from the side menu. You will then see a field in which to enter the amount of earnings, as well as buttons that allow you to clarify the form of employment and additional factors that affect the actual final "take home" amount.

The first scenario involves an employment contract. In this option, we enter the gross amount and then specify whether off-site work is involved. Then we get the calculated net amount, which in the case of an employment contract equals the final "take home" amount.

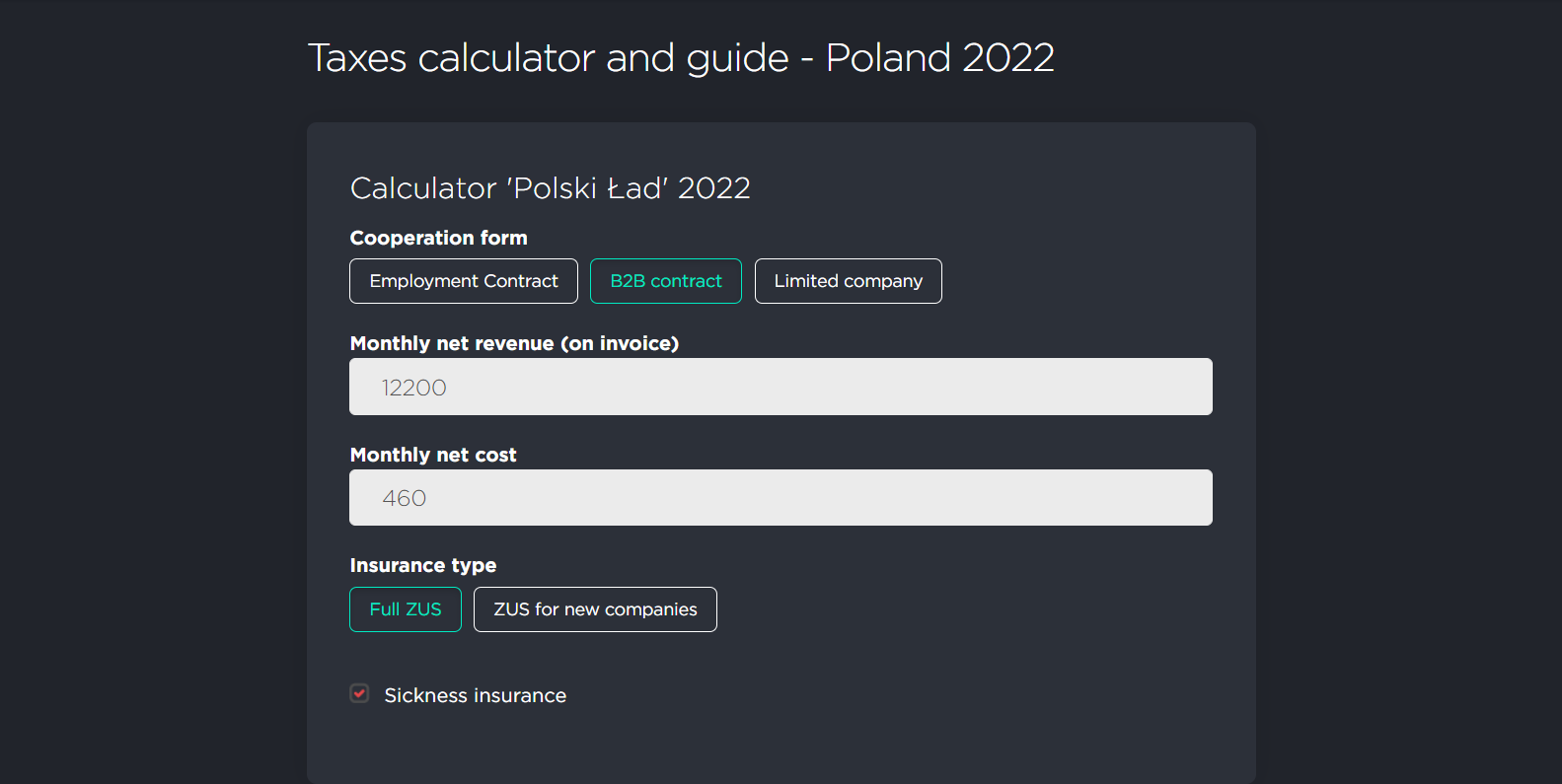

The second variant of the calculation applies to a B2B contract, which is usually an individual entrepreneurship. Here we already have two fields at our disposal – in the first one we should enter the net amount for which the invoice is issued. Lower down, however, we enter the cost of conducting economic activity, also net. In the end, all we have to do is choose whether we will pay the full insurance rate or whether we are still eligible for the new business relief. The final step is to determine whether we are using Social Insurance Institution (ZUS) sickness insurance.

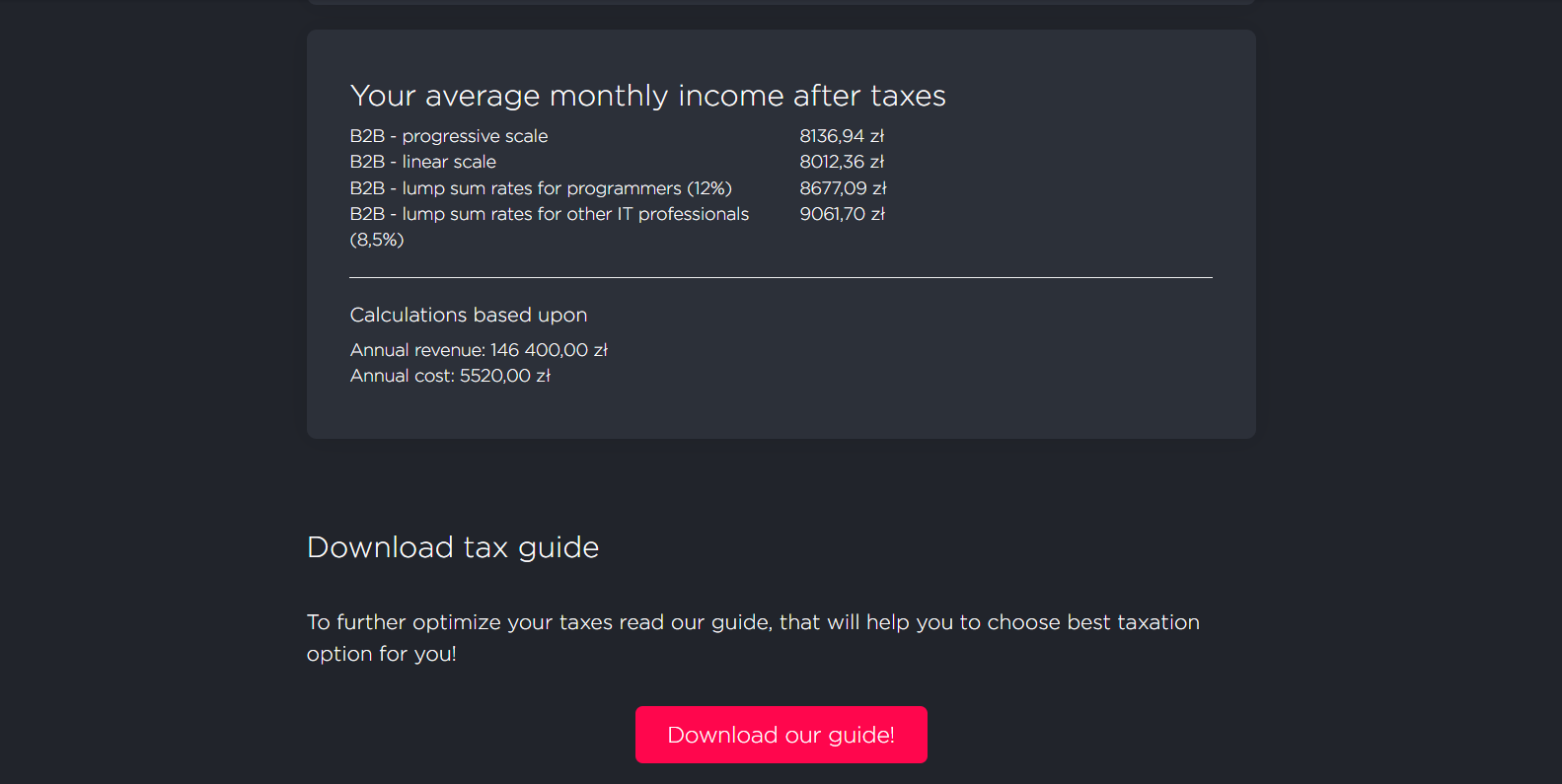

The results of the calculation correspond to the form of taxation selected by the user. Sequentially from the top, the progressive scale, linear scale, as well as a lump sum for programmers and finally a lump sum for other IT workers is displayed.

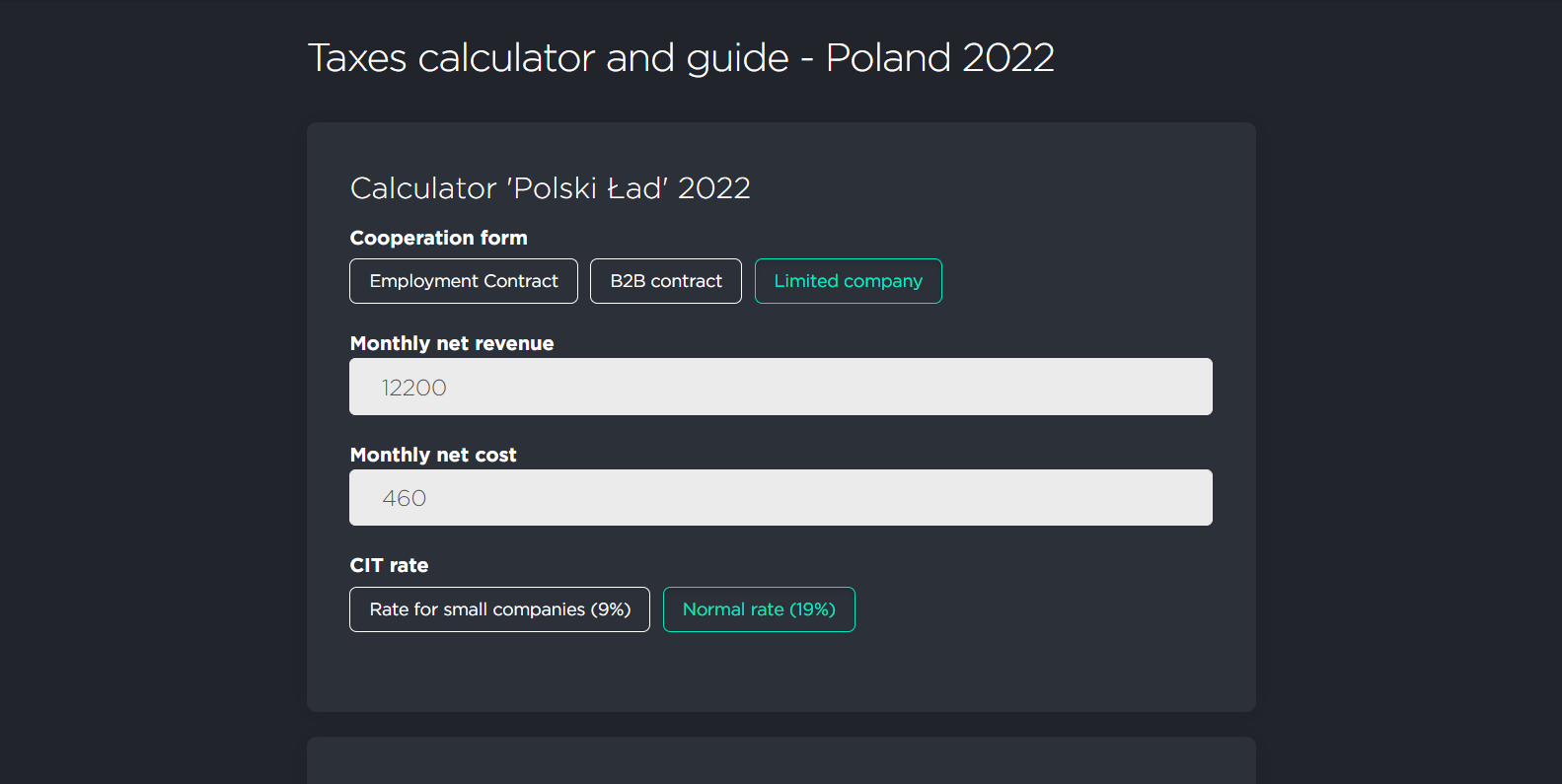

The last option is cooperation within the scope of a limited company. Here you enter your net income and net costs, and then choose whether you pay the 9 percent tax for small businesses or the full 19 percent tax.

However, it doesn't stop there! In the Bulldog Guide salary calculator you will also find a valuable tax guide developed in cooperation with the KPPW Legal & Tax, so that anyone working in the IT industry can find answers to their questions about recent tax reforms.